Mileage Rate 2025 Pennsylvania

Mileage Rate 2025 Pennsylvania. Irs mileage rate change in 2025: Standard mileage rate increase for 2025.

(this is up from 65.5 cents per mile. 67 cents per mile driven for business use, up 1.5 cents from 2023.

Irs Mileage Rate Change In 2025:

Employee business deductions not allowed for pennsylvania tax purposes.

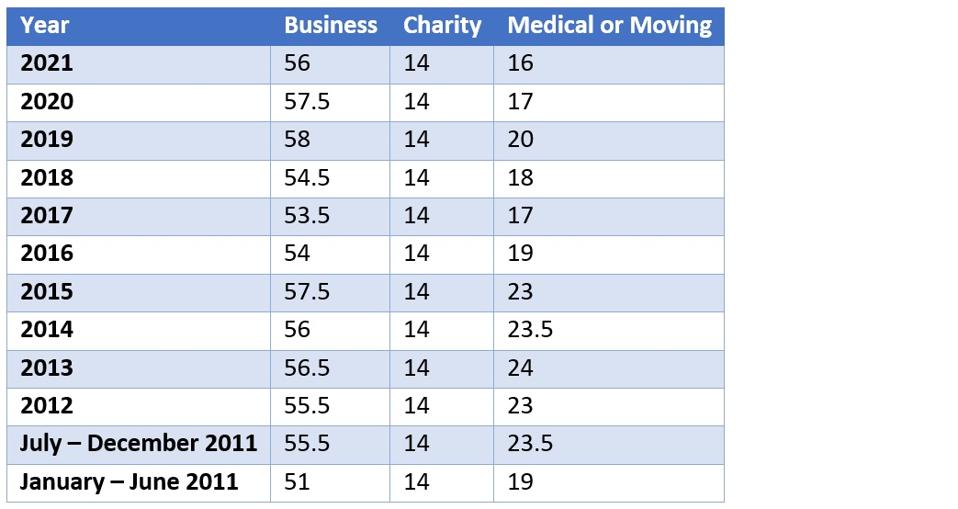

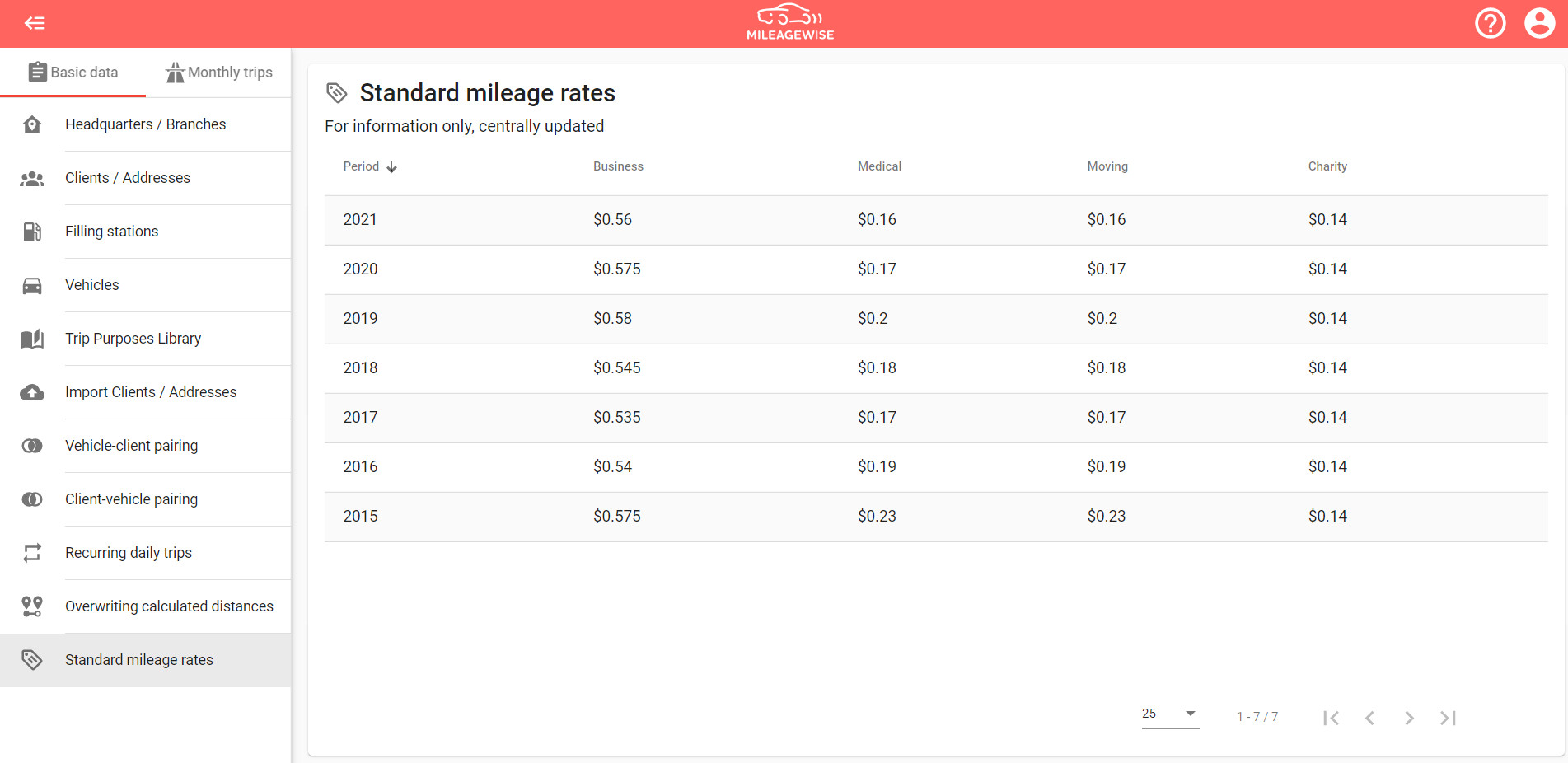

Looking Back Over The Last Decade Of Irs Standard Mileage Rates Provides Helpful Context On What Drivers Can Expect In 2025.

The average pennsylvania mileage reimbursement rate according to our sources, the average mileage reimbursement rate in pennsylvania is higher than the.

Mileage Reimbursement = (Number Of Miles Traveled) X.

Images References :

Source: higion.com

Source: higion.com

Free Mileage Log Templates Smartsheet (2023), $4 per mile for each loaded mile beyond 20 loaded miles of a trip: In addition, the notice provides the maximum fair market value.

Source: timeero.com

Source: timeero.com

IRS Mileage Rate for 2023 What Can Businesses Expect For The, $13.20 per mile for each loaded. 17 rows 2023 mileage rates.

Source: financiallevel.com

Source: financiallevel.com

Table showing historical IRS mileage rates, Commonwealth’s personal vehicle mileage reimbursement rates are equivalent to the rates established by the u.s. * airplane nautical miles (nms) should be converted into statute miles (sms) or.

Source: expressmileage.com

Source: expressmileage.com

IRS Standard Mileage Rates ExpressMileage, The rate for business use will be. Ground mileage, per statute mile:

Source: cardata.co

Source: cardata.co

Pennsylvania Mileage Reimbursement rules and rates Cardata, Commonwealth traveler claims for personal vehicle mileage are reimbursed according to ground travel policies and the applicable gsa mileage rate. $13.20 per mile for each loaded.

Source: bdteletalk.com

Source: bdteletalk.com

Aaa Mileage Rate 2023, Click county for rate sheet. Commonwealth’s personal vehicle mileage reimbursement rates are equivalent to the rates established by the u.s.

Source: www.koamnewsnow.com

Source: www.koamnewsnow.com

IRS increases mileage rate for remainder of 2022 Local News, $4 per mile for each loaded mile beyond 20 loaded miles of a trip: The average pennsylvania mileage reimbursement rate according to our sources, the average mileage reimbursement rate in pennsylvania is higher than the.

Source: www.mileagewise.com

Source: www.mileagewise.com

Standard mileage rates MileageWise Help, Employee business deductions not allowed for pennsylvania tax purposes. Effective january 1, 2025 , the higher standard rate will.

Source: www.cardata.co

Source: www.cardata.co

Cardata The IRS announces a new mileage rate for 2023, Commonwealth traveler claims for personal vehicle mileage are reimbursed according to ground travel policies and the applicable gsa mileage rate. 17 rows 2023 mileage rates.

Source: celissewalena.pages.dev

Source: celissewalena.pages.dev

Irs Mileage Rate 2025 Dee Libbey, The standard mileage rates for 2023 are: The average pennsylvania mileage reimbursement rate according to our sources, the average mileage reimbursement rate in pennsylvania is higher than the.

Using The 2025 Rate Of 67 Cents Per Mile, The Formula For Calculating Your Mileage Reimbursement Is As Follows:

Beginning on january 1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

You Do Not Need To Do.

Effective january 1, 2025 , the higher standard rate will.